A VC-25A Air Force One aircraft sits on a ramp at Offutt Air Force Base, Nebraska during a brief stop Jan. 22. The aircraft is one of two modified Boeing 747 Airliners that serve as a transport aircraft for the President of the United States. (U.S. Air Force Photo by Josh Plueger/Released)

WASHINGTON — Boeing’s defense business logged a nearly $1 billion loss in the third quarter of 2023, including a newly disclosed nearly $500 million hit on its Air Force One replacement known as the VC-25B, the company disclosed to investors today.

Hemmed in by struggling fixed-price development contracts combined with supply chain woes, executives at the plane maker have braced investors for losses in its defense business until at least the 2025-2026 timeframe. Yet they also made clear today that the eye-popping third quarter loss for Boeing Defense, Space & Security (BDS) is not acceptable and a departure from recovery plans.

“These are disappointing results in the quarter and year to date. This performance is below our expectations and we acknowledge that we aren’t as far along in this recovery as we expected to be at this stage,” Chief Financial Officer Brian West said during the company’s earnings call today.

The loss should not come as a total surprise to investors considering West previously warned BDS would be negative in the third quarter. But the company’s overall loss for the quarter was reportedly worse than what financial analysts were expecting. West said today Boeing’s free cash flow remained in the $3 billion to $5 billion-range for the year, but that it would likely come in closer to the “low end.”

According to Boeing’s earnings release [PDF], the aerospace giant logged $924 million in charges for BDS for the third quarter of 2023, the largest for the sector since a $2.8 billion loss disclosed during the third quarter of 2022. This most recent loss was driven by a $482 million charge on the VC-25B program due to “higher estimated manufacturing cost related to engineering changes and labor instability, as well as resolution of supplier negotiations,” the company’s release says.

The VC-25B program has been something of a problem child for Boeing, whose fixed-price structure has forced the contractor to absorb over $2.4 billion in losses to date, according to a Boeing spokesperson. The program’s contract, negotiated by then-Chief Executive Officer Denis Muilenburg with then-President Donald Trump in 2018, has vexed the company’s current leadership, with incumbent CEO Dave Calhoun stating during an earnings call last year that the contract presented “a very unique set of risks that Boeing probably shouldn’t have taken.”

The second largest loss driver for the current quarter was a $315 million loss on a “satellite contract due to estimated customer considerations and increased costs to enhance the constellation and meet lifecycle commitments,” the release says. Boeing did not name the program in question.

West further stated during the company’s earnings call that the company “had smaller, less material cost pressures across a couple programs, totaling $136 million,” which were “primarily driven” by the MQ-25 Stingray refueling drone for the Navy.

Following news that Lockheed Martin is backing out of consideration for the Air Force’s next tranche of tanker procurement — a move analysts view as giving a leg up to Boeing’s KC-46A — Calhoun said he was “not surprised” about Airbus pursuing the contract alone. “I do like what it ultimately does for us in the competition,” he added.

Defense was not the only sector to take a hit. The company reduced its projections for deliveries of its popular civilian 737 MAX airliner this year due in part to supplier issues with Spirit AeroSystems, a blow to airlines hungry for new jets as demand for travel booms. Spirit has since brought on former Boeing executive (and former senior Pentagon official) Pat Shanahan as its new interim CEO, a move Calhoun praised during the earnings call today.

“I’ve heard from a few of you wondering if we’ve lost a step in this recovery. You might not be surprised to hear that I view it as exactly the opposite,” Calhoun said today, pointing to more “rigor around our quality processes” and fostering “a culture of speaking up” to proactively identify problems.

“We still have work to do. But progress is clear. And our focus is long term,” he added. “We’re on the right path to restoring our operational and financial strength. And we thank you for your patience.”

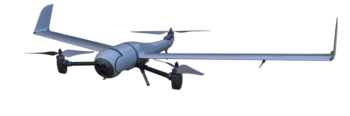

Providing an asymmetric advantage with quadcopters and fixed-wing VTOLs

The American-made Teal 2 quadcopter and Edge 130 Blue, a VTOL fixed-wing system, are both on the Defense Innovation Unit’s Blue List for acquisition by U.S. forces.

![RS179755_PMCS2620-FCAS-JPN-5A[1x1]](https://breakingdefense.com/wp-content/uploads/sites/3/2024/12/RS179755_PMCS2620-FCAS-JPN-5A1x1-e1734095138256-225x150.png)