BANGKOK — Amid the focus on China’s growing submarine fleet and the protracted debate about AUKUS, other East Asian countries continue to invest in submarines, seeking to add boats or to finally acquire them to counter rivals and defend their interests as tensions in the region rise.

Many of those plans have been in motion for years, but interest has only intensified as the security outlook in East Asia has worsened. Major investments by Northeast and Southeast Asian militaries have made the region “a hotbed for undersea-warfare developments,” the Institute for International and Strategic Studies said in its latest Military Balance report, published in February.

In a region with the world’s largest archipelagic countries, submarines garner special interest because of their utility in controlling and defending sea lanes. For navies seeking distinction, subs can be a matter of prestige or a way to keep pace with their neighbors. Some in the region want new subs “to improve their existing capacities” and others “to create an undersea arm to their naval inventories to provide insurance against political uncertainties,” the IISS report said. While the subs those countries operate or are building vary in capability, they represent a buildup that has major implications in a region defined by access to the sea.

In Northeast Asia, some of the US’s closest partners have already put advanced subs in the water this year. The highest-profile of them was Taiwan’s first Hai Kun-class submarine. After its unveiling in September, it underwent harbor acceptance testing until late February, when it was launched for sea trials. It is expected to be delivered to Taiwan’s navy later this year and commissioned in 2025.

The Hai Kun is Taiwan’s first domestically built sub and required years of work that was made more difficult by China’s efforts to intimidate suppliers, but with help from foreign partners Taipei was able to build the boat in roughly two years. It aims to build another by 2027 and to have eight total. (Taiwan currently has two subs built by the Netherlands in the 1980s and two US-built WWII-era subs.)

The diesel-electric Hai Kun has six torpedo tubes that can fire US-designed Mk 48 torpedoes and Harpoon anti-ship missiles. It pairs those weapons with US-made combat systems and sensors. Officials have said later models may carry submarine-launched anti-ship missiles, reflecting Taiwan’s focus on being able to sink the Chinese warships that are sure to surround the island if a war breaks out.

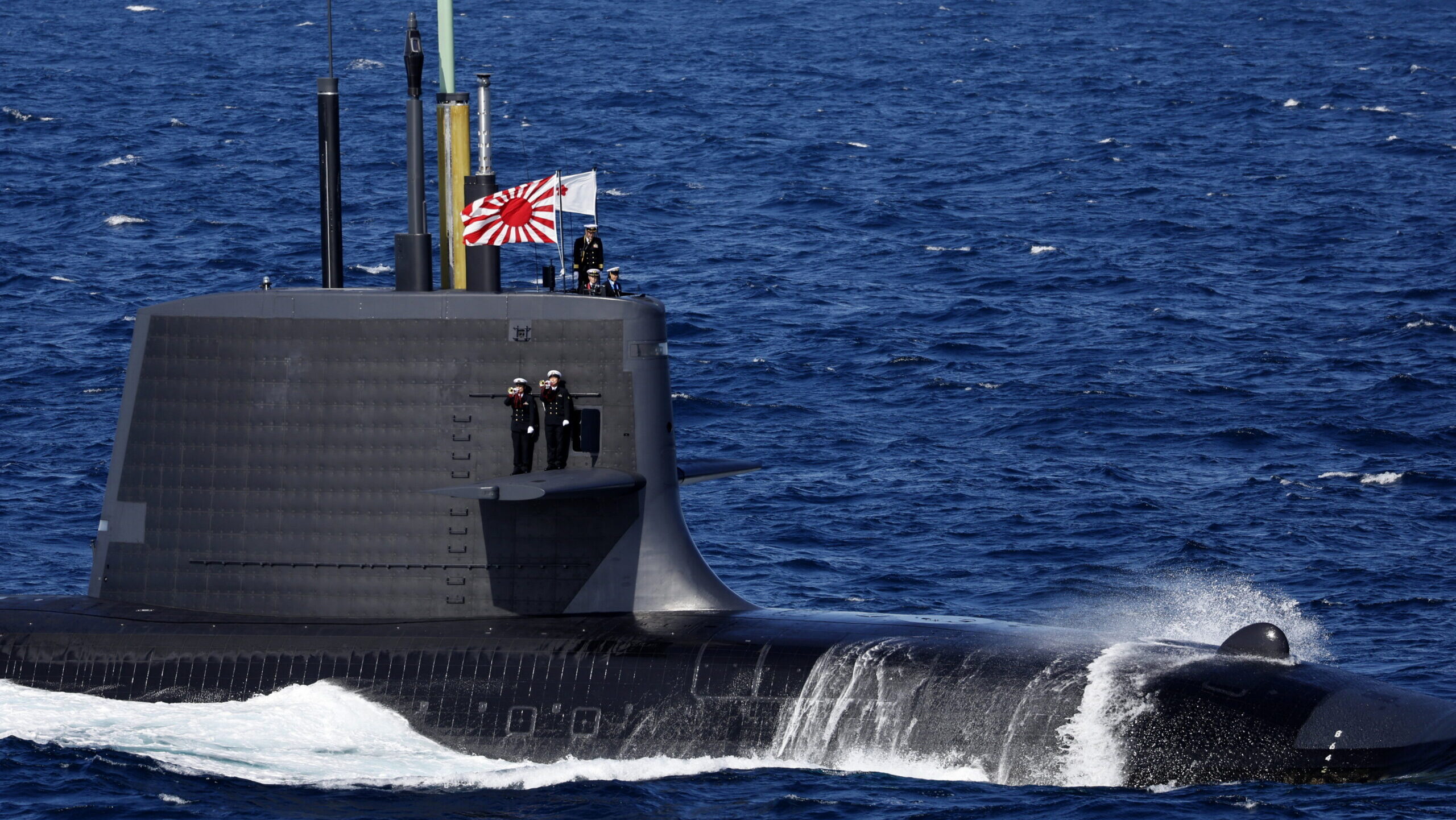

In early March, Japan commissioned its latest Taigei-class diesel-electric attack sub, the third-in-class JS Jingei. Japan has launched a Taigei-class sub every year since 2020, a cadence that attests to its shipbuilding capability and allows it to retire subs after relatively short service lives while maintaining a 22-sub fleet. The original Taigei was converted to a test sub the same day Jingei was introduced.

Japan’s new subs are the largest it has built since World War II and have a number of improvements, including a stealthier design and better sensors, along with six torpedo tubes that can also launch Harpoon anti-ship missiles. Like the last two boats in the previous Soryu-class, Taigei-class subs have lithium-ion batteries, which have longer endurance, charge faster, and allow greater acceleration than traditional lead-acid batteries. The batteries are also pricey and tricky to use safely, and Japan’s navy is the first known to use them on subs.

Several more Taigei-class subs are to be built this decade, but Kawasaki Heavy Industries is already working on Japan’s next class of diesel-electric subs. Those boats are expected to include a vertical-launch system for Japan’s new and improved standoff missiles, a capability needed “to gain underwater supremacy,” according to Japan’s December 2022 Defense Buildup Program.

South Korea also continued its decades-long submarine expansion this year, launching its latest diesel-electric attack sub, ROKS Shin Chae-ho, in April. It is the third and last of the first batch of the Dosan Ahn Changho-class, with two more three-sub batches to come. (The class is itself the third phase in a program that has churned out attack subs since the 1990s, giving Seoul a fleet of more than 20 boats.)

Displacing over 3,300 tons, the Batch I subs are South Korea’s largest and have a number of advanced features, including domestically developed fuels cells paired with an air-independent propulsion system that allows them operate submerged for up to 20 days. Notably, each sub has six vertical launch tubes housing conventionally armed ballistic missiles, a unique capability that puts South Korea’s navy in rare company.

The reasons each of those nations, all three closely aligned with the US, are similar: defending its territory from a nearby threat.

Seoul’s development of sub-launched ballistic missiles, which can reach their target faster than cruise missiles and are generally more survivable than land-based missiles, reflects its concern about being able to preempt or respond to a North Korean attack. Pyongyang has rapidly expanded its nuclear arsenal and improved its own missile capabilities, including with sub-launched models.

Similar concerns about North Korea and China motivated Japan’s acquisition of standoff cruise missiles, with which it could strike enemy missile launchers or naval forces. But Japan’s military is still focused on self-defense, which means the navy’s missions “will remain to defend the archipelagic waters and maritime features, particularly the 1st island chain,” said Benjamin Blandin, network coordinator at the Yokosuka Council on Asia-Pacific Studies.

Japan’s subs “would simply patrol and generate de facto area denial to Chinese submarines and surface vessels” along the first island chain, Blandin said, adding that in “a high-intensity, direct confrontation between the US and China, over Taiwan or the South China Sea,” Japan may extend its territorial seas beyond their current 3 nautical mile limit to “deny passage to Chinese ships.”

Taiwan would also want to use its subs to impede Chinese naval operations, but like Taiwan’s other big-ticket defense acquisitions, there is doubt about the suitability of subs for the threats it faces. Critics say the boats eat up scarce defense dollars and wouldn’t last long in a conflict with China, which is expanding its navy and improving its anti-submarine-warfare capabilities. Proponents say the boats have a deterrent effect and could disrupt Chinese naval activity around the Taiwan Strait and help prevent a blockade of Taiwan’s east coast ports.

Sea lanes and prestige

Southeast Asian navies also continue to pursue new submarines, but only one, Singapore, has put one in the water this year. It launched the fourth and last of its Invincible-class diesel-electric subs, Inimitable, in Germany in April. The other three subs of the class were launched in Germany in 2019 and 2022, but only one has arrived in Singapore, where it is undergoing sea trials ahead of expected commissioning later this year.

The four new subs are expected to be in service by 2028 and will replace Singapore’s four aging Challenger- and Archer-class subs. Those subs, built for Sweden in the 1960s and 1980s, respectively, were modified for Singapore when they were acquired, but the Invincible-class boats are custom-built to operate in the warm, shallow, and crowded waters around the city-state.

Singapore says the new subs have “advanced automation and indigenously-developed sense-making systems” to enable better situational awareness and responsiveness, as well as air-independent propulsion systems powered by fuel cells that allow them “to stay submerged about 50% longer” than Archer-class subs. They will “carry a wider range of mission payloads” and their eight torpedo tubes will likely be able to deploy a range of weapons, including heavyweight torpedoes.

Several other countries in the region have taken major steps toward new submarines this year.

In February, Philippine President Ferdinand Marcos Jr. approved the purchase of a submarine in the next phase of the country’s military modernization program, which is focusing on maritime and aerial assets amid a shift toward defense against external threats. Manila plans to buy more than one sub, but its navy has never operated subs before, so it will require years of investment and training to ensure it can use and maintain them effectively.

In March, Indonesia signed a contract with France’s Naval Group for two Scorpène Evolved diesel-electric attack subs, which will be built in Indonesia. The subs are designed for oceanic and shallow-water operations and have lithium-ion batteries, six torpedo tubes that can also launch missiles, and “operating autonomy” that allows for reduced crew size, the company said when the contract was signed. Indonesia has four subs in service — three Nagapasa-class subs commissioned between 2017 and 2021 and a Cakra-class sub built over 40 years ago — and is aiming for at least 10, though a 2019 contract for three more Nagapasa-class subs appears to have foundered.

In Thailand, a decade-long effort to build a new subs cleared a hurdle in May but still needs years of work. Bangkok began looking for new subs in the mid-1990s (it retired its last subs in 1951) and eventually selected China’s Yuan-class subs in 2015, drawn by their air-independent-propulsion and weaponry, including torpedoes and anti-ship missiles. The contract for the first of up to three boats was signed in 2017. Construction started in September 2018 with delivery expected by 2023.

The deal was unpopular from the outset, both because of the expense and perceptions that it was made for political rather than practical reasons. Thailand has long been a US ally, but the military government’s decision to buy a Chinese submarine, rather than a European-designed boat favored by the navy, was seen as a rebuke of Washington for its criticism of Thailand’s 2014 military coup. The deal also reflected deepening Sino-Thai relations, which expanded under the military government and now have major economic implications for Thailand.

Despite the criticism, the Thai government has pressed on with the deal. It has been delayed repeatedly, however, most notably by a requirement that the sub have a German-made engine, which Berlin would not sell to China. Thai and Chinese officials wrangled over that issue for years and looked set to swap the sub for a Chinese-built frigate last year, but in May they agreed to use a Chinese engine on the sub instead. Thailand’s defense minister has said it will still take a month or two to finalize the new arrangement and the government will then have to approve the change, but the commander-in-chief of the Royal Thai Navy now expects the sub to be delivered in three years.

Southeast Asia’s pursuit of submarines is a long-term trend — Malaysia received two Scorpène-class boats in 2009 and 2010, and Vietnam acquired six Russian-built Kilo-class subs between 2014 and 2017 — but there isn’t a single issue driving the interest, said Collin Koh, a senior fellow and expert in naval affairs at the S. Rajaratnam School of International Studies in Singapore.

Some of those countries have sought subs in response to a direct threat. The Philippines and Vietnam “most plausibly hold classical threat perceptions towards China in the [South China Sea] that motivate their quests for submarines,” Koh said.

Others are motivated by more general concerns and in some cases by prestige. Singaporean officials have said their new subs are “a strategic asset” for “the crucial mission” of keeping sea lanes open and “securing Singapore’s access to the seas.” In Thailand, officials have cited a need to defend their waters but also a desire to keep up with their neighbors’ growing fleets.

“For most of the countries in SE Asia which are establishing new undersea fleets or expanding existing forces, the primary motivation appears to be one conditioned by a sense of insecurity amid the geopolitical uncertainty — hence submarines as an insurance to hedge — and the bid to ‘catch up with the Joneses,’” Koh said.

Christopher Woody is a defense journalist based in Bangkok. You can follow him on Twitter and read more of his work here.